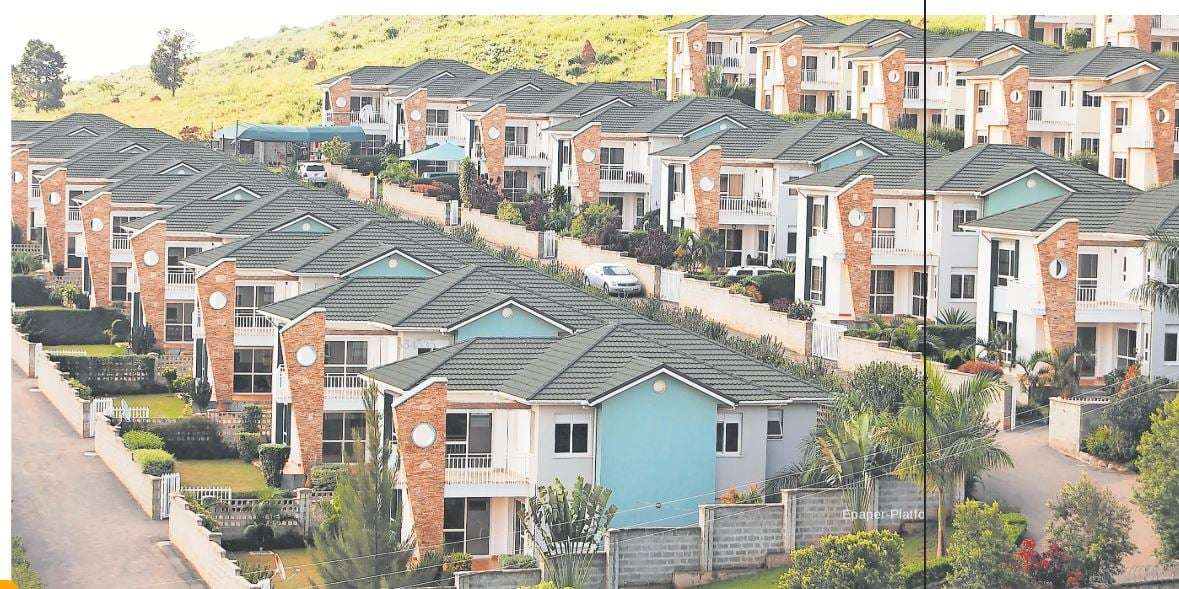

Gated residential estates have become a hallmark of suburban growth in areas like Lubowa, Najjera, Kira, and Bukasa. These developments cater to middle- and upper-class homeowners seeking enhanced security, communal amenities, and a controlled living environment. The gated community market in Uganda has grown by an estimated 25% annually since 2021, reflecting both aspirational trends and genuine safety concerns.

Market Dynamics & Drivers

- Security Perception: Crime rates in urban centers have prompted buyers to prioritize estates with 24/7 security, access control, and perimeter fencing. Surveys by the Private Sector Foundation Uganda (PSFU) indicate that 62% of estate buyers cite security as their main purchase driver.

- Lifestyle Amenities: Modern gated estates feature clubhouses, swimming pools, gyms, children’s play areas, and green spaces. Developers like Pegasus Estates and Bethel Estates have incorporated themed parks and jogging tracks, appealing to families and health-conscious professionals.

- Social Prestige & Exclusivity: Gated estates often command higher land and unit premiums—up to 30% above open-market rates—due to perceived status symbols and exclusivity.

Regulatory & Planning Considerations

- Estate Governance: The absence of clear legal frameworks governing estate management leads to disputes over service charges, maintenance responsibilities, and estate rules. In response, the Ministry of Lands drafted the Estate Management Regulations 2024, seeking to standardize by-laws and resident committees.

- Infrastructure Service Levels: Developers must ensure reliable provision of utilities—such as borehole water systems, backup generators, and waste management services—to maintain estate appeal. NWSC supply inconsistencies have prompted some estates to build independent water reservoirs and treatment facilities.

Challenges & Risks

- Service Charge Conflicts: Reports show that escalating service fees, often rising by 10–15% annually, lead to resident pushback and legal challenges, as seen in court cases involving the Luxor Estate in Kira.

- Quality Assurance: Rapid construction to meet demand has occasionally resulted in substandard materials and infrastructure failures—e.g., collapsing perimeter walls and malfunctioning sewage lines—requiring developers to establish rigorous quality control processes.

- Exclusion Concerns: Critics argue that gated estates exacerbate social segregation and strain public infrastructure by diverting resources from wider community development.

Private Sector Innovations

- Community Management Platforms: Tech solutions like EstateLink offer residents digital portals for fee payments, maintenance requests, and community announcements, improving transparency and efficiency.

- Green Estate Designs: Leading developers are integrating solar street lighting, rainwater harvesting, and small-scale waste recycling plants within estates to promote sustainability and reduce operational costs.

- Mixed-Income Models: To address exclusivity critiques, some developers introduce mixed-income blocks—allocating 20% of units for lower-income buyers at subsidized rates, in partnership with NGOs like Habitat for Humanity.

Investor Implications

- Premium Margins: Well-managed gated estates can achieve land price premiums of 20–30% and rental yields of 8–10%. However, budget for ongoing estate management and reserve fund contributions.

- Social License to Operate: Engaging local communities through employment opportunities and infrastructure investments fosters goodwill and reduces regulatory hurdles.

- Long-Term Viability: Sustainable design features and digital management platforms can lower operational costs and enhance estate resilience, appealing to environmentally conscious and tech-savvy buyers.

Conclusion

Gated communities in Uganda represent a maturing market segment balancing security, lifestyle, and exclusivity. As regulatory frameworks solidify and developers adopt sustainable, inclusive models, these estates will continue attracting discerning buyers. Key indicators to watch include the enactment of Estate Management Regulations in mid-2025 and the uptake of mixed-income and green estate developments by late 2025.